north carolina estate tax exemption 2019

However you may trigger a gift tax at the federal level. The estate and gift tax exemption is 114 million per individual up from 1118 million in.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Federal exemption for deaths on or after January 1 2023.

. North Carolina Department of Revenue. - A permanent residence owned and occupied by a qualifying owner is. 2019 North Carolina General Statutes.

1 Transfers pursuant to court order including transfers ordered by a court in administration of an estate transfers pursuant. Up to 25 cash back Under the North Carolina exemption system homeowners can exempt up to 35000 of their home or other real or personal property covered by the homestead exemption. North Carolina Department of Revenue.

Link is external 2021. Federal estate tax could apply as well. First the states 2 million exemption was indexed for inflation on an annual basis.

Estate and inheritance taxes are burdensome. The capital gains tax rate is 15 percent for taxpayers in the 25 28 33 and 35 percent tax brackets climbing to 20 percent for those in the 396 percent bracket. That means that your estate would have to be worth at least that much before you would even need to start thinking about estate taxes.

Even though North Carolina does not currently impose an estate or inheritance tax if the decedent bequeathed out-of-state assets to surviving family taxes in the alternate jurisdiction might apply. And if you are married you can double that. 26 rows What is the North Carolina estate tax exemption.

105-2771 - Elderly or disabled property tax homestead exclusion. 47E-2 - Exemptions. Article 12 - Property Subject to Taxation.

The federal estate tax exemption is 1206 million in 2022 so only estates larger than that amount will owe federal estate taxes. As of 2021 the exemption sits at 2193 million and the top tax rate is 20. An estate tax is a tax imposed on the estate of a decedent upon their passing.

If an estate is worth 15 million 36 million is taxed at 40 percent. The Internal Revenue Service announced today the official estate and gift tax limits for 2019. NC Gen Stat 47E-2 2019 47E-2.

Application for Extension for Filing Estate or Trust Tax Return. That top bracket starts at 418400 for single filers and 470700 for married couples filing jointly. 21 2019 North Carolina attempted to tax the income of the Kimberley Rice Kaestner.

A set of North Carolina homestead exemption rules provide property tax relief to seniors and people with disabilities. The Executor must file a federal estate tax return within 9 months and pay 40 percent of any assets over that threshold. Of course the current lifetime exemption is very high compared to historic levels.

Purchasers Affidavit of Export Form. A disabled veteran is defined as a veteran whose character of service at separation was honorable or under honorable conditions and who has a total and permanent service. Then the estate tax rates for the top four brackets increased by one percentage point.

In a closely-watched decision the US. North Carolina excludes from property taxes the first 45000 of assessed value for specific real property or a manufactured home which is occupied as a permanent residence by a qualifying owner. 2019 North Carolina General Statutes.

Supreme Court unanimously ruled that a beneficiarys residence within a state alone does not subject a trust to such states income tax. NC Gen Stat 105-2771 2019 105-2771. NC K-1 Supplemental Schedule.

Elderly or disabled property tax homestead exclusion. The estate tax exemption was then increased in 200000 increments to reach 3 million in 2020. Beneficiarys Share of North Carolina Income Adjustments and Credits.

Kimberley Rice Kaestner 1992 Family Trust No. Individuals effectively shield 1206 million for 2022 or 117 million for 2021 from estate taxes assuming they never breached an annual gift tax exclusion in their lifetime. That limit is the applicable lifetime gift and estate tax exemption when you pass away.

Chapter 47E - Residential Property Disclosure Act. At the Federal level there is currently as of 2017 a 549 million exemption. Streamlined Sales and Use Tax Certificate of Exemption Form.

Homeowners age 65 or older whose spouse is deceased can exempt up to 60000 under the homestead exemption if the property was previously owned by. Owner or Beneficiarys Share of NC. In North Carolina Dept.

Finally certain family-owned businesses received an estate tax exemption of up to 25 million. As of 2019 if a person who dies leaves behind an estate that exceeds 114 million. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million.

The estate tax rate was adjusted so that the first dollars are taxed at a 9 rate which ultimately maxes out at 16. PO Box 25000 Raleigh NC 27640-0640. Chapter 105 - Taxation.

If you are totally and permanently disabled or age 65 and over and you make. Up to 25 cash back However now that North Carolina has eliminated its estate tax most wealthy North Carolina residents will owe estate taxes only to the federal government. A The following transfers are exempt from the provisions of this Chapter.

Property Left to the Surviving Spouse. North Carolina no longer enforces its own gift tax. Art firearms historic memorabilia and other collectibles may be subject to certain taxes.

Individual income tax refund inquiries. The estate tax exemption is the amount a. In the Tax Cuts and Jobs Act the federal government raised the estate tax exclusion from 549 million to 112 million per person though this provision expires December 31 2025.

January 3 2019 525 PM.

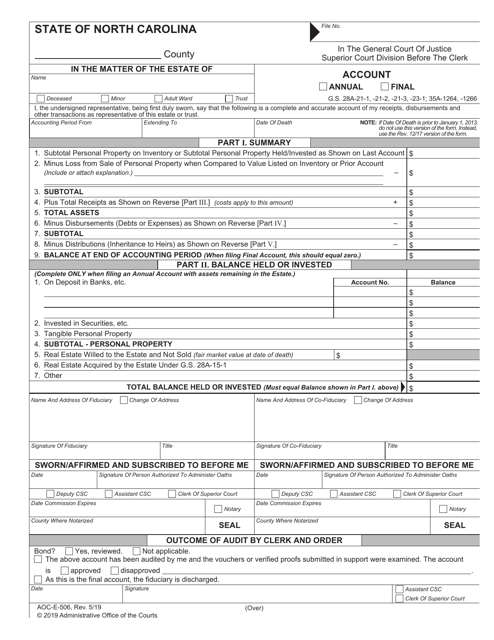

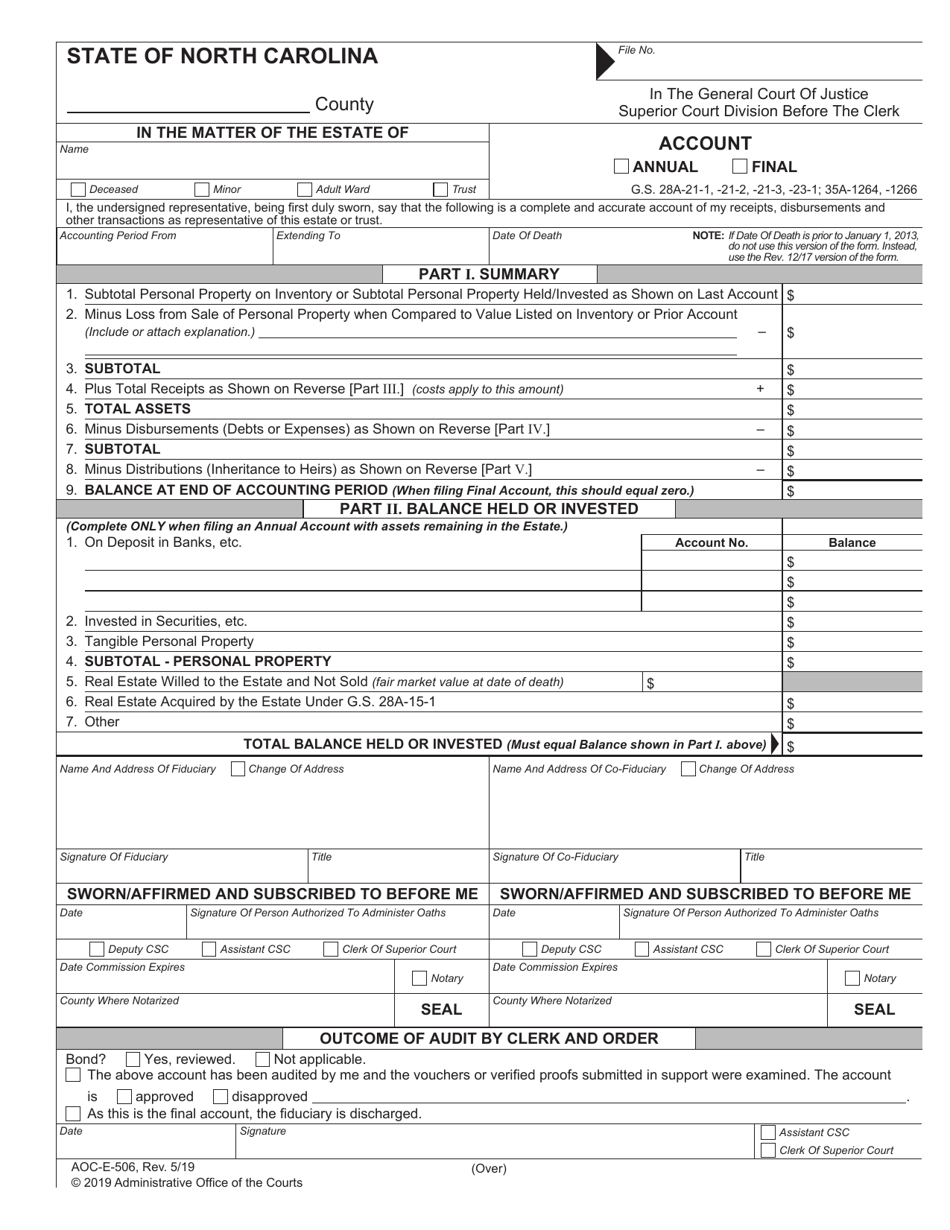

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

Form Aoc E 506 Download Fillable Pdf Or Fill Online Account North Carolina Templateroller

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

1 54 Mil Daniels Gate A Castle Rock Luxury Home Mansion Designs Property Real Estate Luxury Homes

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Tax Reform North Carolina Tax Competitiveness

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

What Is Probate And Why You Need To Know

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

North Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Lockdown A Testing Time For Couples Sayings City New Facebook Page

North Carolina Tax Reform North Carolina Tax Competitiveness