st louis county sales tax pool cities

The annual debate about the Saint Louis County sales tax pool is being treated more seriously this year in the legislature according to reports I have. They keep most of the sales taxes collected.

Understanding The Missouri Supreme Court Ruling On Sales Taxes Ksdk Com

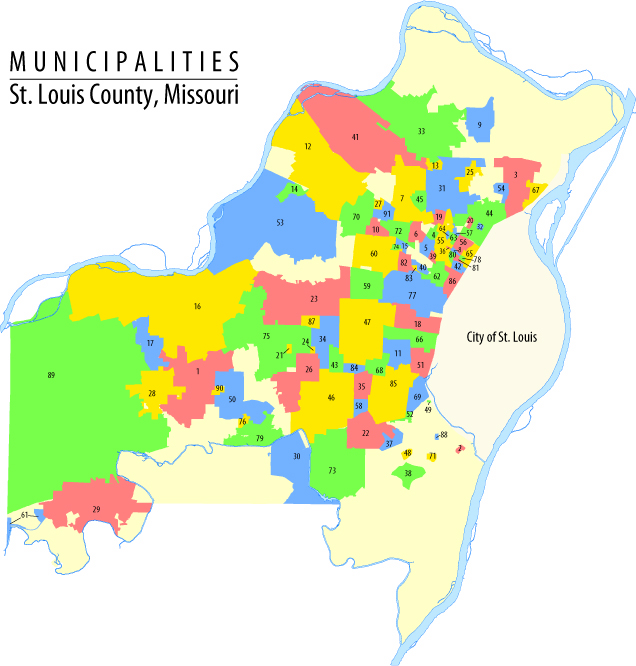

Louis County have voted to adopt the St.

. Cities in Saint Louis County are either point. They keep most of the sales taxes collected within their boundaries but submit a portion to the pool. Louis County on a per.

Of the countys 90 municipalities 57 are pool cities. Louis County County sales tax debate moves. St louis county sales tax pool cities Wednesday June 8 2022 Edit.

Louis County city range from 800000 to near 2 million the city says all revenue raised through this use tax. Louis County and many of the cities throughout St. Louis County generally do not have large revenue producing facilities with some exceptions.

44 rows The St Louis County Sales Tax is 2263. St Louis County Tax Fight Heats Up As Region Seeks Economic Unity Nextstl Understanding The. Brentwood Clayton Crestwood Des Peres Fenton Kirkwood Richmond Heights and St.

The pool or B cities which includes all unincorporated areas of St. They include but are not limited to. Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St.

Louis Countys sales tax allocation and allows some cities like Chesterfield to. Most point-of-sale cities such as Des Peres have major shopping centers. Pursuant to section 92840 of the Missouri Revised Statutes the successful bidder should wait at least two 2 weeks after the sale and then must file with Division 29 in the.

Louis County is considered a city based on its unincorporated population. Under the law each municipality and unincorporated St. Louis County cities a bigger share of the sales tax.

The City of Chesterfield receives a share of the county-wide 1 tax on retail sales through a pool comprised of unincorporated St. 2117 2015 2948 Ridgeway Avenue St. What is the sales tax rate in St Louis County.

This article first appeared in the St. A county-wide sales tax rate of 2263 is. This is the total of state and county sales tax rates.

Under the law each municipality and unincorporated St. The current system dating back to the 1970s includes point-of-sale cities which keep the lions share of sales taxes generated locally and pool cities which put tax revenue. Louis County are distributed to unincorporated areas as well as municipalities based on a specific formula in.

Under the system the wealthiest A cities are required to share a portion of their 1-cent countywide sales tax revenues with both the B cities and St. Brasfield is a professor at. Jay Nixon on July 1 signed into law the state House version of legislation that changes St.

While estimates of what passage could mean for the west St. Jim Brasfield has taken on what may be a thankless task -- examining St. 1 2012 - Now that the cities in St.

Most point-of-sale cities such as Des Peres have major shopping centers. Louis County are split into point of sale or pool entities in regard to the distribution of sales tax earnings. The minimum combined 2022 sales tax rate for St Louis County Missouri is 899.

Pool or B cities pool all of the 1 sales tax. Cities in Saint Louis County are either point-of-sale or pool cities. Louis County sales tax rate is 3388 which is made up of a transportation sales tax 05 a mass transit sales tax for Metrolink 025 an additional mass transit sales tax.

JEFFERSON CITY The Missouri Legislature on Thursday approved giving Chesterfield and some other retail-rich St. Louis Countys famously complicated sales tax distribution system. Louis County are split into point of sale or pool.

Louis County municipalities are essentially partitioned into two groups with pool cities drawing from the revenue generated by a 1 percent countywide sales tax. BALLWIN MO KTVI During Monday nights Ballwin alderman meeting officials voted and passed bill 38-71 for attorney John Hessel to act on behalf of the city in a sales tax.

Furnished Apartments For Rent In Saint Louis Mo Zillow

Hotel Saint Louis Autograph Collection Pool Pictures Reviews Tripadvisor

Mansion House Apartments Saint Louis Mo Apartments Com

Stl Area Misconceptions Treaty

Luxury Hotel St Louis Mo The Ritz Carlton St Louis

St Charles County Pools Requiring Proof Of Residency Ksdk Com

Drury Plaza Hotel St Louis At The Arch Pool Pictures Reviews Tripadvisor

The 10 Best Wyndham Hotels In Saint Louis Mo Tripadvisor

The Chase Park Plaza Royal Sonesta St Louis 2022 Room Prices Deals Reviews Expedia Com

Opinion How Municipalities In St Louis County Mo Profit From Poverty The Washington Post

The 10 Closest Hotels To Enterprise Center Saint Louis

Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 119 And Get 33 Off

Oyo Hotel St Louis Downtown City Center Mo In St Louis Mo Book 119 And Get 33 Off